Money is something we all deal with, day in and day out. It’s no surprise that we’re often told to save money today, so it can help us out tomorrow. One of the most effective ways to stay on track with saving is by using money-saving charts. They help keep you motivated and focused on your financial goals, whether you’re building an emergency fund, saving for a vacation, or even putting money aside for Christmas.

In this post, I’m going to share some of the best money-saving charts I could find to help you stay on top of your financial goals and make saving money easier!

Why Use Money-Saving Charts?

Money-saving charts are not only helpful but also essential for staying on track with your financial goals. Here’s why you should use them:

- Visual Reminder of Your Goals: A chart gives you a visual reminder of what you’re working towards, so you never forget why you’re saving.

- Keeps You Accountable and Motivated: Watching your progress can keep you motivated, especially when you see how far you’ve come. It holds you accountable, so you stick to your financial goals.

- Customizable: You can easily modify a chart to fit your specific needs, whether it’s for saving for a vacation, buying a house, or paying down debt.

Get Your Financial House in Order With These Money-Saving Charts (2024)

Here are some great money-saving charts that will help you organize your finances and reach your goals this year:

- Baby Steps Towards Financial Independence

Dave Ramsey is well-known for his “Baby Steps” approach to personal finance. This chart will guide you through paying off debt, saving for emergencies, and building wealth, all while working toward financial independence. - The Basics of Saving Money

If you’re new to saving money, this simple chart helps break it down. It’s a basic approach that focuses on cutting back on unnecessary spending and prioritizing savings. It also teaches you the difference between needs and wants, so you can start saving more effectively. - How to Save Money on Food

Food can be one of the biggest expenses in any household. This chart gives you tips and strategies on how to cut down on food costs while still eating healthy and delicious meals. It’s a simple way to stretch your food budget. - How to Save Money on Transportation

Between gas, insurance, and maintenance, transportation can take a big chunk out of your income. This chart offers easy tips on how to save money on transportation costs, like using public transport, carpooling, or cutting back on unnecessary driving. - How to Save Money on Utilities

Electricity, gas, and water bills are unavoidable, but you can reduce them by being mindful of your usage. This chart provides practical tips on how to save on utilities, from turning off lights when not in use to using energy-efficient appliances. - How to Save Money on Groceries

Grocery shopping is one of the most common areas where people overspend. This chart breaks down how to make smarter grocery choices, avoid impulse buys, and stick to your budget, helping you save a significant amount of money each month. - How to Save Money on Vacation

Planning a vacation? This chart helps you save money without sacrificing the fun! It suggests smart tips for cutting vacation costs, such as booking in advance, choosing affordable destinations, and looking for travel deals.

How to Save Money for Life’s Milestones and Goals

:max_bytes(150000):strip_icc()/cropped-image-of-hand-putting-coins-in-jars-with-plants-755740897-5ab88ee1875db9003759d390.jpg)

Here are some charts that focus on saving for big life events:

- Save Money for a House Deposit

Dreaming of buying a house? This chart helps you save for a house deposit by breaking down how much you need to save each month to reach your goal. It’s perfect for anyone looking to take the first step toward homeownership. - Save Money for Retirement

It’s never too early to start saving for retirement. This chart shows you how to set aside money for your future, no matter how far off retirement might seem. It will help you make saving for retirement a habit and ensure you’re financially prepared when the time comes. - Save Money for a Wedding

Weddings can get expensive, but this chart helps you break down the costs and set realistic savings goals. Whether it’s for the ceremony, reception, or honeymoon, it helps you save in manageable steps. - Save Money for a New Baby

Having a baby is a huge milestone—and it’s expensive. This chart guides you through the costs of preparing for a new arrival and helps you save for everything from diapers to baby furniture. - Save Money for College

Planning for your child’s education? This chart helps you save for tuition, books, and other college expenses. It gives you a clear idea of how much to save each month to reach your goal. - How to Save Money After College

College may be over, but the financial journey continues. This chart provides tips on saving after graduation, including paying off student loans and building a solid savings foundation.

Money Saving Challenges

If you like a little challenge, these charts are for you. They turn saving money into a fun game:

- 52-Week Money Saving Challenge: Save $1,820

This is a simple, year-long challenge where you save a little more each week. By the end of the year, you’ll have saved $1,820. - Save $1,000 Each Year

This challenge helps you set small, achievable goals throughout the year, ultimately saving $1,000. It’s a great challenge to jumpstart your savings. - The 30-Day Money Challenge

A shorter challenge that encourages you to save each day for a month. This chart shows you how to save small amounts daily, which adds up to big savings by the end of the month. - Save Money for Christmas Challenge

Christmas can be expensive, but with this challenge, you can save gradually throughout the year. The chart helps you set aside money for holiday gifts and festivities, so you’re not scrambling last minute.

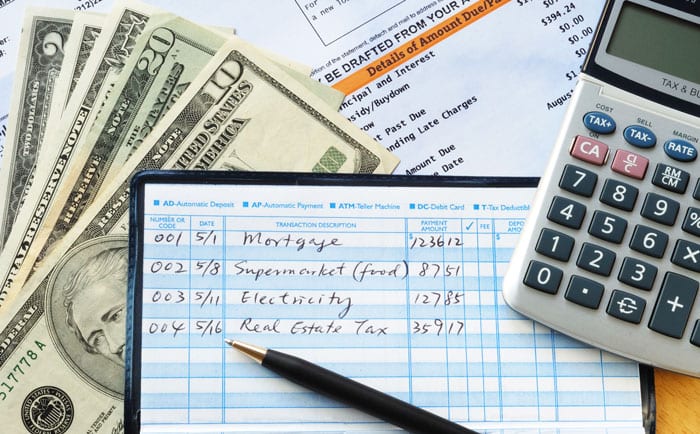

How to Budget Money

If you need help organizing your budget, these charts can guide you:

- The 70% Rule

This chart helps you manage your income by allocating 70% for living expenses, 20% for savings, and 10% for debt repayment or investment. - Money Envelope System

A simple way to stick to a budget by using envelopes for different spending categories (like groceries, entertainment, etc.). This system helps prevent overspending.

FAQs About Money-Saving Charts

- What exactly are money-saving charts?

Money-saving charts are visual tools designed to help individuals track their progress toward saving specific amounts of money. These charts are used to set goals, stay accountable, and monitor how much is saved over time. They are effective for organizing finances and making saving money more tangible. - Why are money-saving charts useful?

Money-saving charts offer several benefits:- Visual reminders: They keep your savings goal in sight.

- Motivation: Seeing progress motivates you to keep saving.

- Accountability: They hold you accountable for reaching your goals.

- Customization: You can tailor them to your specific needs, whether saving for a house, a vacation, or an emergency fund.

- How do I use a money-saving chart?

- Set clear goals: Determine what you’re saving for (emergency fund, vacation, etc.).

- Break it down: Divide the total amount you need to save into smaller, manageable targets.

- Track progress: Use the chart to mark milestones and monitor how much you’ve saved.

- Stay consistent: Regularly add the required amounts and update your chart to stay on track.

- Are there different types of money-saving charts?

Yes, there are many types of money-saving charts:- Goal-specific charts: For saving for a house, retirement, or education.

- Money-saving challenges: Fun challenges like the 52-week challenge or 30-day savings challenge.

- Budgeting charts: For tracking income and expenses, like the 70% rule or money envelope system.

- Spending reduction charts: Focus on saving money by reducing costs in areas like food, transportation, and utilities.

- Can I make my own money-saving chart?

Absolutely! Money-saving charts are fully customizable. You can create a personalized chart based on your specific goals, timeframes, and financial situation. Many online resources provide free templates for easy creation. - What are money-saving challenges and how do they work?

Money-saving challenges are structured plans that encourage saving small amounts over time, typically with a set goal in mind:- 52-Week Challenge: Save a progressively larger amount each week, totaling $1,820 by the end of the year.

- Save $1,000 Challenge: Set smaller, monthly goals to save a total of $1,000.

- 30-Day Challenge: Save a little amount every day for 30 days to boost your savings quickly.

- What are the “70% rule” and “money envelope system”?

- 70% Rule: A budgeting method where you allocate 70% of your income for living expenses, 20% for savings, and 10% for debt repayment or investment.

- Money Envelope System: A physical way to manage your budget by dividing cash into different envelopes (e.g., for groceries, entertainment, etc.). This helps prevent overspending in each category.

- How can money-saving charts help with long-term goals like retirement or buying a house?

Money-saving charts are a great way to break long-term goals into manageable steps:- For retirement, the chart can show you how much to save each month to ensure you’re financially prepared for the future.

- For a house deposit, the chart helps you track the savings needed and the amount you should set aside each month to reach your goal.

- Can money-saving charts help me save for Christmas and other holidays?

Yes! There are specific charts like the Save Money for Christmas Challenge, which helps you save small amounts each month so that you’re not scrambling for cash during the holiday season. This can help ease the stress of last-minute holiday shopping. - How can money-saving charts improve my financial discipline?

By visually tracking your savings, you develop a consistent saving habit and avoid impulsive spending. They help you focus on your priorities, stay organized, and keep you accountable to your financial goals.

Conclusion

Money-saving charts are a powerful tool to help you take control of your finances. They offer a structured, visual way to manage your savings, hold you accountable, and keep you motivated to achieve your financial goals. Whether you’re saving for an emergency fund, a vacation, or a big life event like buying a home, these charts can keep you on track. Choose one that suits your goals and start saving today!